Making a Will is commonly seen as something to do later in life. People in their 20s often think they do not need to make one but below are 5 good reasons to make a Will, whatever your age.

1. To make sure your boyfriend or girlfriend inherits

If you live with your partner but are not married, then your partner will not benefit under the intestacy rules. If you want your partner to benefit on your death, you will need to make a Will.

2. To provide for your pets

Household pets, such as cats and dogs, are covered by the legal definition of chattels (personal possessions) and so can be left in your Will in the same way as your other possessions. You can therefore include a legacy in your Will to leave your pet to a friend or family member.

3. To give your friends something to remember you by

Many people in their 20s have more student debt than assets but even if you do not own a house or have much money, you will no doubt own items that are important to you. Items such as jewellery, musical instruments and books can be left to your loved ones in a Will.

4. To deal with a jointly owned property

If you own a property with someone else, it could be sensible that you make a Will. This is particularly important if you own the property as ‘tenants in common’, which means that your share of the property does not pass automatically to your co-owner on your death (this would only happen if you own your property as ‘joint tenants’) . Under the rules of intestacy, your closest relatives will inherit your share (probably your parents.) Therefore, if you would like your co-owner to inherit then you must either make a Will or make sure that you own your property as ‘joint tenants.’

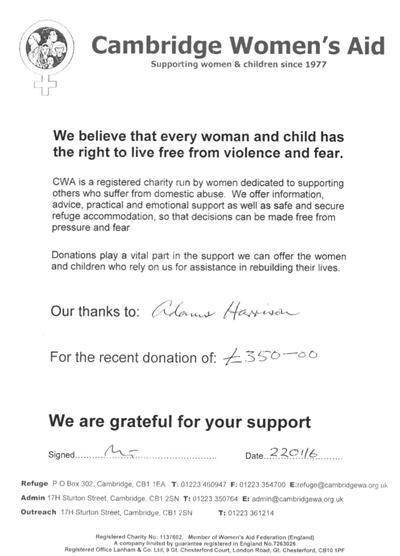

5. To leave money to charity

Many people choose to leave money to a charity in their Will. Even if you are strapped for cash, your modest donation might make a big difference to a charity.

For further information about making a Will, please contact a member of our Private Client department for expert and professional advice.

We are pleased to welcome Whitney Jacque as a new member of our conveyancing team.

We are pleased to welcome Whitney Jacque as a new member of our conveyancing team.